epf malaysia employer contribution

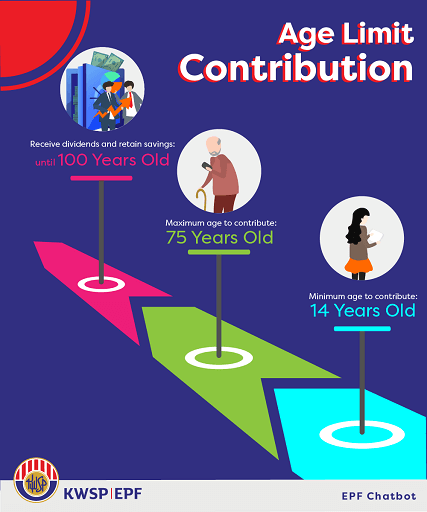

Government contribution is limited to members who are below age 60. 6 Income Tax FAQ 大马个人所得税需知.

Confluence Mobile Support Wiki

For Singapore Citizens and Permanent Residents.

. Whether youre an employee or employer calculate your CPF contributions payable with the most updated CPF contribution rates as of 2022. An employer who employs one or more employees is required to register and contribute monthly to SOCSO for all employees under the Employees Social Security Act 1969 henceforth refer as Act. Yusri earns RM7000 per month.

Register your employees as EPF members and keep their information updated. The annual EPF contribution by employer and employee sums up to RM 7841 billion as of Q4 2020. But for i-Saraan you need to inform EPF that you wish to apply for i-Saraan so that youre entitled to the 15 matching incentive from our government maximum RM250year incentive from our.

March 10 2021 Home Financial Plan Banking. In this article we have summarized the facts about EPF for both the employers and. How to Pay EPF Self Contribution Online.

Contribute according to your own time and within your own financial ability and still be able to make withdrawals. Shahar said that as of June 30 662 million members or 52 of the total of 1278 million EPF members aged under 55 had savings of less than RM10000. 马来西亚旧钱币 Malaysia Old Coins.

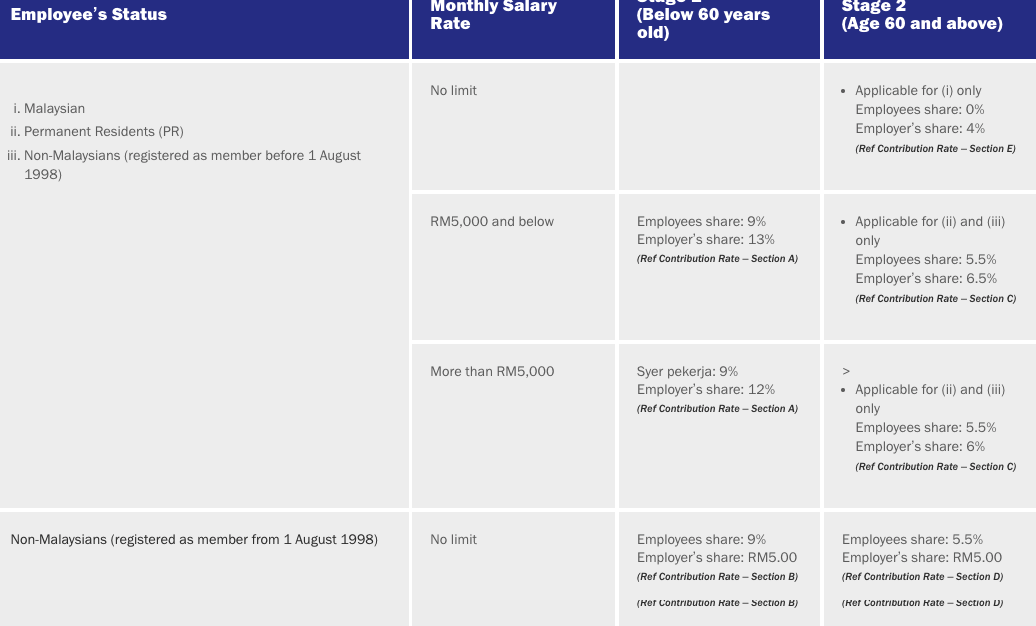

Retirement avenue for those who are self-employed or do not earn a regular income. At Talenox we believe in designing HR experiences for people not personnel. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age.

Provide salary statements to employees. At least 534398 employers in Malaysia have contributed to EPF. Pensionable public servant category Life insurance premium.

As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing policies and requirements. We can pay EPF or KWSP ourselves self contribution online using Maybank2U. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021.

In total he would have. Life insurance and EPF INCLUDING not through salary deduction. Not applicable to members that receive a fixed employer contribution.

Even if youre back to full-time employment with EPF contribution from you and your future employer you can still make additional EPF contribution through self contribution. From January 2016 there is an income tax relief of MYR 25000 per annum for SOCSO contribution. Here we put together a tool for you to accurately calculate CPF contribution.

From January 2019 all the foreign employees are. According to the scheme the EPF contribution by employer and employee are both made available. A person or a owners who do not get salary own business is encouraged to participate the EPF Self.

This means that Yusris EIS contribution from his employer is RM790 and his own contribution would also be RM790. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

OTHER than pensionable public servant category Life insurance premium Restricted to RM3000 Contribution to EPF approved scheme Restricted to RM4000 7000 Restricted 19. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. The employer should then send this form to EPF.

For employees working in Malaysia registered entities be it local or foreigner work pass holders it is a norm to see in their monthly pay slip indications of monthly contribution deducted from their monthly salary as well as their employersThis article will explain in detail what these monthly deductions entails to and why they are required by the Employment Act 1955. The Master Prospectus of ASNB dated 1 February 2020 the First Supplementary Master Prospectus dated 20 October 2021 the Prospectus of ASN Imbang Mixed Asset Balanced 3 Global dated 16 September 2020 the First Supplementary Prospectus ASN Imbang Mixed Asset Balanced 3 Global dated 20 October 2021 and the Prospectus of ASN Equity Global. His EIS contribution would be capped at a salary of RM4000.

Collect your employees share of EPF contribution and submit it to the EPF along with the employers share. Register with the EPF as an employer within 7 days upon hiring the first employee.

St Partners Plt Chartered Accountants Malaysia Epf缴纳率下调至7 的可要注意了 Reduction Of Statutory Epf Contribution Rate From 11 To 7 Employers Are Required To Use The Amendment Third Schedule As Follows For

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

St Partners Plt Chartered Accountants Malaysia Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Documents 20126 927226 Bi Jadual Ketiga 2020 Kwsp Pdf

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Epf Self Contribution Should You Do It And How Life Of A Working Adult

How To Calculate Your Epf 2010 Msia Hr News

26 Oct 2020 How To Plan Supportive Government

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Confluence Mobile Support Wiki

Epf Contribution Rates 1952 2009 Download Table

Steps To Apply Employee S Epf Contribution Rate At 11

What Are The Employer And Employee Contribution To Epf Quora

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Comments

Post a Comment